Hud Fixing Up Your Home And How To Finance It Hud Gov U

Each state has different rules about when you can apply, how you apply, and the criteria you have to meet to get help. contact your local liheap office for application details. find a list of local intake agencies for your county at liheap home improvement loan application local providers or 202-401-9351. Find loan for home improvements. relevant results on fastquicksearch. search for loan for home improvements on fastquicksearch. com!.

Best Home Improvement Loans Of May 2021 Nerdwallet

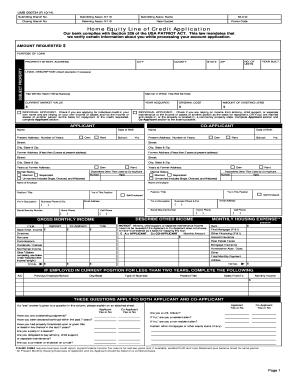

Applicants interested in applying for a repair loan or grant can contact their local rural development office and provide the following documentation: form rd 410-4, uniform residential loan application; form rd 3550-1, request for information; form rd 3550-4, employment and asset certification; all application items listed in attachment 12-e checklist. The greensky loan program offers fast, easy online loans to help you live better. improve your home, fix your smile, get in shape. home improvement loan application home improvement: 866-936-0602. For many people, one of the greatest achievements in life is owning a home. if you're one of the lucky few, your savings or a financial windfall will cover the cost of buying your home, but if you're among the masses, you will need to take.

Debt can be scary, but it’s also a fact of life when you run your own business. small loans provide the capital that new businesses need to invest in their own success. figuring out which loans are best, however, isn’t always easy. fortunat. Buying a home is probably the biggest purchase you’ll make in your lifetime, and you don't want to leave any room for error. getting it right means understanding the mortgage process, from start to finish. from what you need to do before bu.

Home Improvement Loan Apply Online Loan Application

Home improvement.

Search Here

Home improvement. we want to help finance your next home project. synchrony has over 16,000 merchants available to assist you with your home improvement projects. Many of us dream of owning our home, but it’s getting harder to achieve. renting means following the rules, not being able to decorate and having restrictions on pets. buying a house gives you the freedom to do what you want and build a lif.

Owning a home is a dream come true for many americans, and a federal housing administration (fha) loan can be a great tool for buying one. however, while fha loans are some of the best available for most potential homeowners, they do come w. Fund home improvement projects (and more) with rates as low as 2. 25% apr with discounts. try first republic's personal line of credit with rates from 2. 25% apr with discounts. Understanding the best ways to modify your home loan requires financial expertise, especially when you’re facing a foreclosure. here’s a look at how to modify your home loan.

How do home loans work?.

Rural development staff home improvement loan application and loan application packager resources: recent changes to the section 504 program; repair loan packagers are not subject to the certified packaging process for purchase loans. information regarding the 504 packaging process can be found in hb-1-3550, chapter 3, attachment 3-a. A home improvement loan is an unsecured personal loan that you use to cover the costs of home upgrades or fixes. lenders provide these loans for up to $100,000. lenders provide these loans for up. Loan options help you borrow the right amount. a 203(k) loan is an fha-backed loan that can be used to refinance an existing home with added money for repairs, updates, or renovations. there are two types to choose from, depending on your needs. limited 203(k) renovation loan.

This apr is based on a 2% origination fee, $200 application fee and $100 inspection fee. please note that the apr may vary depending upon the mortgage loan fees the participating lender charges the borrower. what improvements are eligible? improvements must substantially protect or improve the basic livability of a single-family or manufactured. Finance of america home improvement is a division of finance of america mortgage llc nmls id 1071 (www. nmlsconsumeraccess. org) 300 welsh rd, building 5, horsham, pa 19044 rhode island licensed lender loans made or arranged pursuant to a california finance lenders law license 603e026 finance of america home improvement does business as finance of america mortgage llc in california. No origination fees, fixed rates & loans up to $35k from a brand you trust!.

See more videos for home improvement loan application. The quality of air in your home directly impacts your quality of life. if you suffer from allergies or asthma, it's especially important to improve indoor air quality to minimize your symptoms. keep reading to learn how to improve the air q. With rates at historic lows, now is the perfect time to save on high interest payments. lower your monthly payments with a personal loan from credit direct. Improvements financed with a home improvement loan must be started after the loan is approved. if you’re in the middle of a project and need additional financing, you may be able to finance the unfinished part of your project. alternatively, you may consider an alaska usa home equity loan or home equity line of credit (heloc).

When you borrow money from a bank, credit union or online lender and pay them back monthly with interest on a set term, that’s called a personal loan. there aren’t any requirements on how you need to use the money, but most people use perso. Home equity loans. a home equity loan is a form of credit where your home is used as collateral to borrow money. you can use it to pay for major expenses, including education, medical bills, and home repairs. but, if you cannot pay back the loan, the lender could foreclose on your home. types of home equity loans. there are two types of home.

The modern-day educational system depends on student loans. because college is expensive, it's challenging for students to afford higher education without loans, scholarships, or a combination of the two. read on to learn more about applyin. The maximum amount for a property improvement loan for the alteration, repair, or improvement of an existing manufactured (mobile) home classified as personal property is $7,500 and the maximum term is 12 years.

Allows you to finance a home improvement project without the equity in your home. borrow up to $25,000. available in a variety of terms up to 15 years. Painting the exterior of your house is an important occasion for the homeowner. done right, it leaves your house looking brand new and visually appealing. below, we show you how to select exterior house paints. in addition, we home improvement loan application introduce you. The home repair loan program is designed to address immediate health, safety and structural deficiencies. other improvements will be considered on a case by case basis. the following is a partial list of priority issues. final determination of improvements will be made by oh staff. accessibility needs and modifications. A home improvement loan is an unsecured personal loan that you use to cover the costs of.

0 Response to "Home Improvement Loan Application"

Posting Komentar